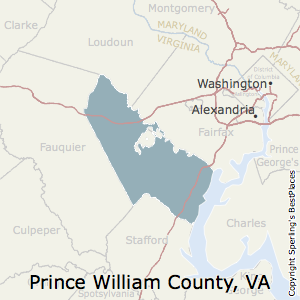

prince william county real estate tax rate

Moving a vehicle INTO Prince William County from another state please register your vehicle and change of address with the Virginia Department of Motor Vehicles DMV 804-497-7100 then. Then they get the assessed value by multiplying the percent of total value assesed currently 100.

Prince William Officials Propose Further Cut In Tax Rate Reduction In Vehicle Assessments Headlines Insidenova Com

The county proposes a new 4 meals tax to be charged at restaurants.

. Enter your payment card information. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

The system will verbally provide you with a receipt number for you to write down. Prince William County collects very high property taxes and is among the top 25 of counties in the United States ranked by. You can read more at Propety Taxes in.

Prince William Virginia 22192. Press 2 to pay Real Estate Tax. A new 4 meals tax is under discussion but would not be considered until next spring.

The Taxpayer Services in-person and telephone office hours are Monday Tuesday Thursday and Friday. Enter jurisdiction code 1036. Johnson presented his proposed budget to the Prince William Board of County Supervisors at their Tuesday Feb.

Taxes may be going up in Prince William County after July 1 with a proposed boost in real estate tax bills a new cigarette tax and an increase in the rate on computer equipment a tax mostly paid by data centers. Counties in Virginia collect an average of 074 of a propertys assesed fair market value as property tax per year. Get driving directions to this office.

Second-half Real Estate Taxes Due. If you have not received a tax bill for your property and believe you should have contact the Taxpayer Services Office at 703-792-6710 or by email at email protected. County Executive Chris Martino presented the budget with a steady real estate tax rate of 1125 per 100 assessed valueHowever because property values have increased an average of 7 the.

Dial 1-888-2PAY TAX 1-888-272-9829. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Learn all about Prince William County real estate tax.

Press 1 to pay Personal Property Tax. To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Supervisors spent two hours deliberating and asking questions about the proposal before taking a series of votes to advertise the proposed 105 real estate tax rate and a 4 meals tax.

The original proposal dropped the rate to 105. 074 of home value. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

The average residential real estate tax bill increases 286 264 from the real estate tax and 22 from the fire levy. The lower tax rate means the county government and schools will receive 68 million less from local real estate taxes next year. How property tax calculated in pwc.

The Board reduced the real estate tax rate from 1125 to 1115 per 100 of assessed value while maintaining a flat fire levy rate of 008 cents per 100 of assessed value. Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County. Prince William County Real Estate Assessor.

Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order. Hi the county assesses a land value and an improvements value to get a total value. The average homeowner will pay about 250 more in Real Estate taxes and fire levy taxes next year.

Last week county officials proposed a further reduction in the real estate tax rate from 1115 per 100 of assessed value to 103. The county assessed home. So if your home is worth 200000 and your property tax rate is.

Tax amount varies by county. 4379 Ridgewood Center Drive Suite 203. FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or Holiday the due date or deadline is the following business date.

Enter the Account Number listed on the billing statement. The median property tax also known as real estate tax in Prince William County is 340200 per year based on a median home value of 37770000 and a median effective property tax rate of 090 of property value. Personal Property Taxes and Vehicle License Fees Due.

703 792 6780 Phone The Prince William County Tax Assessors Office is located in Prince William Virginia. The median property tax in Virginia is 186200 per year for a home worth the median value of 25260000. Virginia is ranked number twenty one out of the fifty states in.

We strive to provide the best customer service to Prince William County residents through our Taxpayer Services Division comprised of our Service Counters Call Center email website and tax portal. The county and school division use a revenue-sharing agreement that traditionally directs 5723 of the countys local general fund tax revenue to schools. Then they multiply that by the tax rate to get your property tax.

Prince Williams board of supervisors is moving toward adopting a budget for fiscal year 2021 that keeps the countys real estate property tax rate flat while increasing the data center and vehicle license taxes to fund some staff pay raises and launch new programs aimed at helping residents cope with the economic fallout of the COVID-19 pandemic.

Housing First The Homeless Hub Homeless Supportive Service Program

Manassas Virginia Old Town Manassas Manassas Virginia Manassas Virginia

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

How Healthy Is Prince William County Virginia Us News Healthiest Communities

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

New 800 Acre Data Center Campus Proposed In Prince William County Virginia Dcd

Prince William County Real Estate Prince William County Va Homes For Sale Zillow

Personal Property Taxes For Prince William Residents Due October 5